When you embark on the journey of homeownership, navigating mortgage repayments can seem like a daunting task. However, understanding how your payments are applied towards your loan can provide clarity and empower you to make informed financial decisions.

Let’s dive into the mechanics of mortgage repayments using an example of a $500,000 loan at 6% interest over 30 years, paying monthly, principal and interest repayments.

Dispelling the Myth: Paying Off Interest First

One common misconception is that mortgage repayments only cover interest initially, and the principal reduction occurs later. However, this is not the case. From the first payment onward, each instalment you make covers both the interest accrued and reduces the principal balance of your loan. This means that with each payment, you’re gradually chipping away at the amount owed.

The Breakdown: First 12 Months

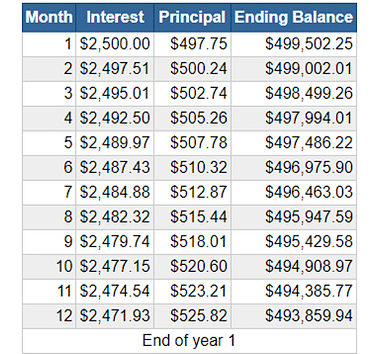

First 12 months amortisation table

In the initial stages of your mortgage, a significant portion of your monthly mortgage repayment goes towards paying off the interest accrued on the loan. Let’s take a closer look at the breakdown for the first 12 months for our example.

Total Monthly Payment: Assuming a fixed-rate mortgage, your monthly payment would be determined based on the loan amount, interest rate, and term. The monthly payment for our example is approximately $2,998.

Interest Portion: In the early months, most of your payment goes towards covering the interest accrued on the loan. For instance, in the first month, the interest portion of your payment is $2,500.

Principal Portion: While the majority of your payment initially goes towards interest, a portion also goes towards reducing the principal amount of the loan. In the first month, this portion might be around $498.

As the principal loan amount reduces, so does the monthly interest. This gradually accelerates the reduction in your principal portion. As you can see from our table above, the principal reduction to your loan increases slightly each month.

Accelerating Loan Payoff: Making Frequent Payments

A strategy to consider to save time and money is making more frequent payments, such as bi-weekly or fortnightly instead of monthly. Since mortgage interest is calculated based on the outstanding principal balance, reducing this balance more frequently can lead to substantial interest savings over the life of the loan.

For example, by splitting your monthly payment in half and making payments every two weeks, you effectively make 13 full payments in a year instead of 12. This extra payment reduces the principal faster, shortening the loan term and saving you money on interest.

Using our same example of the $500000 loan at fixed interest rate of 6% over 30 years. If you were to make mortgage repayments of $1499 per fortnight (instead of $2998 per month) for the term of the loan, you would reduce your loan term by 5 years and 4 months. Also saving yourself over $124000 in interest. By using our mortgage repayment calculator, you can run your own calculations with different repayment amounts and see how long it will take to repay your own loan.

Contact Us today!

Understanding how mortgage repayments are applied towards your loan can empower you to manage your finances effectively and work towards your homeownership goals. By staying informed and exploring repayment strategies, you can make the most of your mortgage journey. To find out more or to discuss your home loan requirements, contact us today to speak to one of our friendly brokers.

Disclaimer: *It’s important to note that the example provided is based on a fixed-rate mortgage with a consistent interest rate throughout the loan term. Mortgage terms and conditions can vary, so it’s essential to consult with your lender or financial advisor to understand the specifics of your loan. The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to your circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced, or republished without prior written consent.